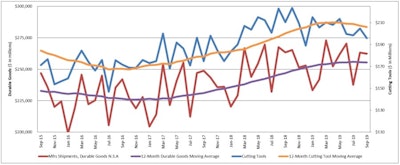

MCLEAN, VA — September 2019 U.S. cutting tool consumption totaled $195.9 million, according to the U.S. Cutting Tool Institute (USCTI) and the Association For Manufacturing Technology (AMT). This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was down 4.3 percent from August's $204.7 million and down 7 percent when compared with the $210.6 million reported for September 2018. With a year-to-date total of $1.8 billion, 2019 is up 0.2 percent when compared with 2018. Please note there were revisions to August 2019.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

According to Brad Lawton, Chairman of AMT’s Cutting Tool Product Group, “The September numbers focus on the one word that describes our everyday attitudes ‘uncertainty,’ and not having a clue of what to expect from our domestic economy and the global economy. So the further understanding of this issue is ever-present from the media, political wars in Washington, the global trade wars, and the overall effects of these issues on the global economies. The changes are not recessionary, but the changes are concerning.”

“It's no surprise that U.S. cutting tool consumption continues to slow on a year-over-year basis as machine tool sales weaken and the manufacturing sector enters a recession — primarily because of the U.S.-China trade. Though cutting tool consumption year-to-date remains slightly ahead of 2018, the cutting tool market will likely continue to soften for the remainder of the year and into 2020 as sales are typically at their low points from November through February — even in years when manufacturing output is rising,” said Alan Richter, Editor of Cutting Tool Engineering Magazine. Alan added, “Another element to consider is that cutting tool manufacturers keep developing and introducing new tool grades that last longer than previous grades enabling part manufacturers to increase throughput. Although the new tools might cost more initially, end-users who set their sights on long-term rather than short-term cost savings are able to reduce their overall production costs by boosting productivity. Toolmakers may sell less product, but their customers increase their competitiveness and are able to survive and, hopefully, thrive as a result of purchasing higher-performing cutting tools.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

The graph below includes the 12-month moving average for the durable goods shipments and cutting tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.