The implementation of global supply chains in response to opportunities and greater customization demands continues to influence a wide range of product development, production and distribution decisions. Amongst these are ways to streamline purchasing processes in eliminating waste and improving customer interactions.

I recently sat down with Patrick Schneidau, the Chief Marketing Officer of PROS, a leading pricing and revenue management software provider to discuss these and other trends.

Jeff Reinke, editorial director, IEN: What do you feel are some of the leading trends impacting the industrial sector, and their investments in pricing management software?

Patrick Schneidau, Chief Marketing Officer, PROS: As manufacturers deal with the complexities of products in different countries and different currencies, they need to arm their people with the right data in order to match pricing strategies accordingly.

Raw materials like oil and steel, which are usually about 75 percent of the total cost of a product, are volatile. So companies have to react on the demand side as quickly as the supply side. The ability to infuse more efficiency in connecting demand, or what the market will pay, with how much to procure is vital to ensuring profitability.

The automotive sector is good example. Suppliers are getting squeezed on pricing, which translates to lower production levels because profits are down. This leads to more aftermarket than OEM business. It’s important to understand these demand dynamics to understand the market’s price sensitivity.

JR: So if the purchasing process needs to take more of these elements into consideration, how has that changed internal investment decisions for manufacturers?

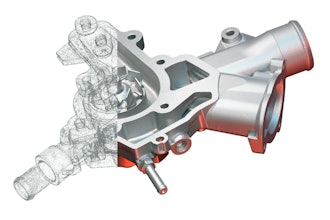

PS: Manufacturing has a very diverse collection of needs from a process perspective. ETO (engineered to order), MTO (manufactured to order), personalization of products, 3D printing – they all focus on providing options that center around greater levels of customization.

Manufacturing is still in an early adoption phase with much of this, and there’s usually a very strong domino effect. Once a leading vendor gets up and running, the others are quick to move in order to compete. This is what we see driving adoption and investment levels.

JR: Are there any specific examples of this follow-the-leader dynamic that you can pinpoint?

PS: Ecommerce comes to mind. As the buying process transitions from more of a digital channel than human to human, understanding how to differentiate between and understand trends with customers becomes even more important. The consumerization of B2B tech is changing how people interact when it comes to buying and selling, so an understanding of that, with a strategy around it, is important.

E-commerce brings together market data, purchasing history, etc. to establish price points. In this arena, everyone wants to emulate what Amazon has done with the same levels of data science and personalization. If manufacturers and distributors don’t adjust, they’re at risk.

JR: So how has PROS responded to these trends?

PS: We’re looking to find areas where technology can create a personalized customer experience. One of the big steps we took is transitioning from on-premise to cloud-based platforms.

Configure Price Quote (CPQ) is another example. CPQ takes requirements directly from the customer in finding the right products in generating a quote as soon as possible. We see a lot of interest in adding efficiency to the process of generating a quote, and the use of analytics around how to price a product when things like geography and differing currencies can complicate it. Our solution is called PROS Smart CPQ.

We’ve also recognized the customer’s desire to buy in smaller pieces to satisfy very specific requirements. That’s how we moved to a new “editions” portfolio with SellingPRO and PricingPRO.

SellingPRO uses data to provide customers with comprehensive quoting, configuration and e-commerce capabilities. Sales teams can convert more deals at the right price, with greater speed, accuracy and scale.

PricingPRO delivers insights into pricing practices to help increase profitability. It enhances pricing execution controls and provides prescriptive, data-driven pricing recommendations.

JR: What do you see as some of the most significant challenges facing the implementation of these potential solutions?

PS: A big one is a lack of understanding that if companies don’t start now, they will be left behind. The business side has been doing things a certain way for a long time and they don’t see the need to change, but consumerization is driving change. Mobile devices are driving change. Companies in the industrial sector need to get their head out of the sand on these changes

Data management is another key area. Most companies realize they have more data structure than they give themselves credit for, but a lot of companies think they have to go outside their four walls for market or pricing data. Use the stuff you have. Understand what you bought, and when you won, then mine that data. Opportunities are there.

Most sellers know their buyers extremely well – better than any data. Our goal is to provide a lens into the market that they didn’t previously have. Nobody can look at all the different suppliers, prices and data points, so simplifying the number of data points around price ranges or what’s in demand provides a deeper level of insight. The closer a seller’s expectations match the recommendations coming from the system, the quicker they can adopt, and the more data they can extract in either defining or refining their strategies.