Any food recall incident is a crisis situation that requires quick action to mitigate any longstanding financial and reputational damage. Metal detection specialist Fortress Technology offers a look at different factors that can make food operators vulnerable to a recall, even with inspection equipment in place.

Quality assurance often runs deeper than the obvious. Rather than considering the ‘if’ it can be prudent to think instead about the ‘when’. To mitigate future contaminant risks means you are not looking for patterns, but future potential holes in the security chain. From a practical perspective, food processing inspection risks should be reviewed every 12 months as part of a defined HACCP assessment.

Here are some specific tactics and strategies:

- Run mock recalls. Don’t wait for a crisis to hit before developing your recall response. It can be advisable to run several mock rehearsals for different product scenarios. Make sure you involve everyone that would be connected to a recall, from quality assurance managers to production line operators, customer service personnel and marketing. Testing your process regularly helps to clarify everyone’s role. Have a contingency team too, to cover holidays and recalls that hit outside of usual operating hours.

- Know your metals. First, there’s the widespread use of stainless steels in the food industry. These are more difficult to detect than ferrous metals such as iron and steel or non-ferrous metals such as copper or zinc. That’s because metal detectors work by monitoring disturbances in an electromagnetic field, caused by magnetic and conductive characteristics of material passing through. Ferrous metals are both magnetic and good electrical conductors so they’re relatively easy to detect. Non-ferrous metals aren’t magnetic but they’re good conductors. Stainless steel, specifically the 300 series, is non-magnetic and is also a poor electrical conductor. These characteristics make stainless steel the most difficult metal type to detect. In practice this means that in a sphere of stainless steel hidden in a dry product typically needs to be 50 percent larger than a ferrous sphere to generate similar signal strength. That disparity can rise from 200 to 300 percent when inspecting wet product with conductive characteristics.

- Consider product flow and shape. Food products come in all shapes, sizes and density. What’s more, products don’t always travel consistently in the same direction when passing through the metal detector aperture. Since size, shape, orientation and position of metal contaminants cannot be controlled, operating a metal detector at the highest possible sensitivity is generally viewed as the best method to detect contaminants. It’s equally important to remember that metal detector performance is usually measured using spheres. However, metal contamination may not be spherical, thus the signal generated by said contaminant can vary. The most extreme example is small diameter wire, which may be easy to detect if it presents to the detector in one orientation, but very tricky to spot if it arrives in a different orientation.

- Test and record. It’s vital to check that any metal detection system is failsafe. For example, if a fault with the reject system means that a contaminant is detected but not rejected, the line should stop automatically until the situation is resolved. Both the detector performance and fail-safe capability should be tested regularly with results kept on record to support traceability. Major retailers will typically have their own codes of practice that specify their testing and reporting requirements, but what happens in theory can be harder to implement in practice. Some metal detector equipment manufacturers – Fortress Technology included – integrate secure, automatic logging of all such information into their systems. This is something where a modest investment up front can lead to savings later on by narrowing the time window during which a problem can go undetected.

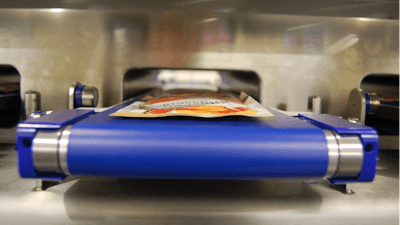

- Size does matter. Because sensitivity is measured at the geometric center of the aperture, the ratio of the aperture to the size of the product is an essential consideration. Maximum sensitivity occurs when the belt and food item is closest to the edge of the metal detector opening, making sense that the smaller the aperture, the more capable it is of detecting the smallest possible contaminants. Users could optimize performance by using several smaller detectors positioned at critical control points throughout the process, rather than a single, big ‘catch-all’ detector at the end of the line. Utilizing upstream metal detection can also identify smaller contaminants, which may not be possible at the end of the line system. HACCP guidance states that critical control points (CCPs) should be located at any step where hazards can be prevented, eliminated, or reduced to acceptable levels.

- Mitigating the risks. When balancing the risks and rewards of investing in optimized metal detectors systems, many users don’t perceive them as generating value for their business beyond the need to comply with customer demands. However, short-term thrift could be an expensive mistake in the longer term. Any food manufacturer should look at this from a risk management perspective. Think of it like fire insurance. No one intends to allow metal to contaminate their food products any more than they intend to burn down their factory, but that doesn’t stop them from investing in fire protection and insurance. In the same way, investing in metal detection reduces the risk of a company’s hard-won reputation. By weighing the cost of equipment versus the cost of a product recall, the decision to invest in good quality inspection equipment should a simple one.