NEW YORK (AP) — Pfizer will acquire Anacor Pharmaceuticals, Inc. in a deal valued at about $5.2 billion.

Anacor's topical treatment for eczema, called crisaborole, is currently under review by the Food and Drug Administration. If approved, Pfizer said it believes peak year sales could reach or exceed $2 billion. Anacor, based in Palo Alto, California, also holds the rights to a topical treatment for toenail fungus called Kerydin.

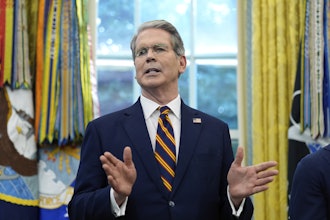

Albert Bourla, group president of Pfizer's global innovative pharma and global vaccines, oncology and consumer healthcare businesses said in a written statement that the buyout is attractive because it provides an opportunity to address a significant unmet medical need for a large patient population with eczema. Bourla said that there are currently few safe topical treatments available for the condition.

Pfizer Inc. will pay $99.25 per Anacor share. That's a 55 percent premium to its Friday closing price of $64.03. Anacor's stock soared more than 53 percent in Monday pre-market trading.

Pfizer expects the transaction to add to its adjusted earnings per share starting in 2018 and increasing after that. The New York company does not expect the acquisition to impact its current 2016 financial outlook.

The boards of both companies have approved the deal, which is expected to close in the third quarter.