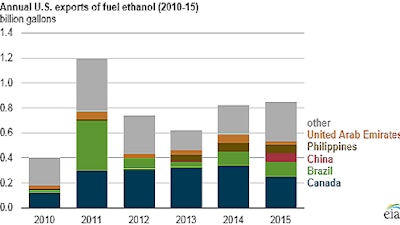

The U.S. Energy Information Administration (EIA) recently reported that U.S. exports of fuel ethanol reached their highest level in four years in 2015, totaling 844 million gallons. This is a slight increase from 2014 and second only to the 1.2 billion gallons exported during 2011. U.S. imports of ethanol, which totaled 73 million gallons in 2014, also increased in 2015, reaching a total of 92 million gallons. The United States remained a net exporter of fuel ethanol for the sixth consecutive year and exported the fuel to 35 different countries in 2015.

In the United States, ethanol is primarily used as a blending component in the production of motor gasoline (mainly blended in volumes up to 10 percent ethanol, also known as E10). Corn is the primary feedstock of ethanol in the United States, and large corn harvests have contributed to increased ethanol production in recent years.

The U.S. Department of Agriculture estimates that the United States produced 13.6 billion bushels of corn in the 2015–16 harvest year (typically October and November), four percent lower than the record set in 2014–15 but on par with the level produced in 2013–14. U.S. ethanol production reached a record level of 14.8 billion gallons in 2015, surpassing the previous record of 14.3 billion gallons set in 2014.

U.S. ethanol demand was driven higher in 2015 because of increased gasoline consumption, which rose by an estimated 2.7 percent from its 2014 level, reaching the highest level since the record set in 2007. As gasoline consumption increases, more ethanol can be used as a blendstock (as E10). Additional volumes of ethanol beyond requirements for E10 blending and relatively small volumes used in higher ethanol blends such as E85 (51 percent to 83 percent ethanol, 49 percent to 17 percent gasoline) were exported.

Canada remained the top destination for U.S. ethanol exports in 2015, receiving 249 million gallons, about 30 percent of all U.S. ethanol exports. Brazil and the Philippines were the next largest importers of U.S. ethanol in 2015, at 116 million gallons and 72 million gallons, respectively.

Driven by growing gasoline demand and air quality concerns, China significantly increased imports of U.S. ethanol volumes in 2015, increasing from three million gallons in 2014 to 70 million gallons in 2015.

U.S. ethanol has been a competitively priced octane booster for gasoline in foreign markets as well as an attractive option for meeting renewable fuel and greenhouse gas emissions programs. In addition, countries such as Canada and Brazil have ethanol-blending mandates that continue to generate demand for U.S. ethanol.

Given the large amount of existing ethanol production capacity, ongoing constraints for blending ethanol into domestic gasoline, and the value of ethanol in foreign markets as a source of clean octane, the United States likely will remain an exporter of ethanol in 2016.

Although the United States was a large exporter of ethanol in recent years, it also imports some ethanol. U.S. ethanol imports totaled 92 million gallons in 2015, an increase of 23 percent from 2014. Almost all (96 percent) U.S. imports came from Brazil, up from 74 percent in 2014, with the remaining gallons coming from Canada.

U.S. import demand for ethanol was primarily driven by Renewable Fuel Standard (RFS) and California Low Carbon Fuel Standard (LCFS) targets for the use of biofuels with low greenhouse gas (GHG) emissions. Lifecycle GHG emissions from sugarcane ethanol production as estimated by scoring systems used in these programs are significantly lower than those from conventionally produced corn ethanol.

The California LCFS, which mandates progressively more stringent requirements for increased blending of low GHG fuel components over time, was particularly important in driving larger volumes of Brazilian ethanol imports in 2015, with 44 million gallons entering the United States on the West Coast, more than triple the 13 million gallons imported in 2014.