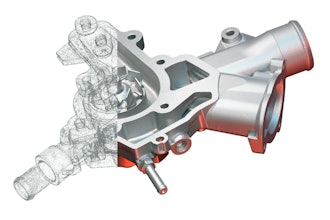

According to the U.S. Bureau of Labor Statistics, manufacturers nationwide are producing more than they did back in 2000. This is due to technology advancements like advanced robotics and 3D printing transforming the industry from product design and production to other operations on the shop floor. Although this is good news for manufacturers, the next very important step for competitive advantage is to have a system in place that gleans valuable insights from the oceans of data these operations create.

Managing any manufacturing business today means dealing with all manner of data pouring in from divisions, departments and every facet of operations. Data is available for the utilization of every piece of equipment and for the output of every employee.

Unfortunately, most finance departments are overwhelmed because they are trying to manage 21st century data flow with 20th century tools – old school error-prone and time-consuming spreadsheet-based systems. Finance departments grind through countless hours of collecting, entering, combining, scrubbing, and testing data from different departments.

Their data streams come from a myriad of different sources, which don’t speak to each other and often don’t agree with each other. And they rarely integrate easily. Data for one spreadsheet cell might be captured separately by operations, quality control, and the finance group. Management must figure out which, if any, gives them the truest picture, rather than spending their time adding value to the business.

Consequently, highly-trained financial professionals are poorly utilized, spending more time collecting data than analyzing it. In this regard, finance teams are acting more as bean counters. They don’t have the time to provide real business value – to create a single true vision of the business across all departments; point to areas that would provide the greatest return on investment; and in many cases are unable to inform the management team of any detail on where the company makes its profit. They are a wasted resource, as is the company’s valuable data.

Contrary to this approach, finance professionals working for manufacturers that have automated their financial processes with a Corporate Performance Management (CPM) platform lets the software do the work of data collection and integration from disparate streams. Freed from tedious work, they become strategic assets, able to quickly glean insights and create competitive advantages from data that enable leadership teams to make smarter, real-world, fact-based decisions.

Typical Benefits of CPM and a Single View

Consider the case of a manufacturer trying to understand why its shipping charges are much higher than projected, and why it has more customer complaints related to shipping. The company tracked unexpected freight charges but didn’t understand why they were incurred or what needed to be fixed. The result was continuous friction between sales, customer service, and the distribution team.

Customer service complained that manufacturing and distribution were not getting products to customers on time. Manufacturing and distribution pointed to sales staff, arguing they did not enter orders properly. Whatever the cause, the result was frustrated and unhappy customers and increased costs (if not lost sales and lost customers.) To meet customer expectations, customer service pushed distribution to use more expensive carriers and services.

Unnecessary costs were being incurred and customer relationships were being put at risk, while management was trying to make decisions based on incomplete and anecdotal information.

This changed however, when the company implemented a Corporate Performance Management (CPM) tool that combines data inputs into a central system, giving managers a single view of operations. Through the system, they identified freight costs by carrier, cross referencing that data to inputs from the customer service group. The truth that management uncovered was that both groups could be wrong, and that using a higher cost carrier to deliver goods didn’t necessarily result in timely delivery.

Managers were able to see trends in order entries and could identify and retrain individuals who had routine or repeat data errors that caused ongoing problems. They could see where the company had a process problem (where the order entry system was a problem for everyone) or where it was a personnel issue.

Fixing the Right Problems

With today’s CPM tools ensuring everyone in an organization can see the same meaningful information, decision-making is more effective. It’s based on facts rather than anecdotes or biases. It means you fix the right problems, which results in smoother running operations and happier customers.

In every organization, finance has an important role in explaining the operational story the data is telling, and recommending remedies when needed. For example, if your customers tend to order smaller packages, how can you entice them to order in bulk to reduce shipping costs?

Different, better and more consistent data also help this manufacturer better manage its labor costs. In manufacturing, direct labor cost go up and down with production volumes. One is a proxy for the other.

If management is seeing labor costs rising or falling, the important question to ask is: is there a direct correlation with production volume? If not, something is amiss. Did a big order come in? Was an order cancelled? Are faulty or clumsy processes eroding efficiency? Delays in getting materials or components?

Without the time and tools to dig into issues like this, Finance can’t point to a solution. Customers end up unhappy, and business is at risk.

Some leadership teams say their finance departments are too busy to adopt a new system. But the reason they are too busy is that they are overwhelmed with low-value tasks. Keeping pace with technological developments in manufacturing is a competitive necessity. But knowing how and where to make investments shouldn’t be a guessing game. Those decisions must be based on facts and that’s where the evolution of the finance role becomes a strategic advantage.

In the old world, Finance closed the books and tracked the balance sheet. With manufacturing output growing again in the U.S., the opportunity for Finance professionals to evolve from number crunchers to business value providers, who understand the story the numbers tell, is a real 21st century competitive advantage.