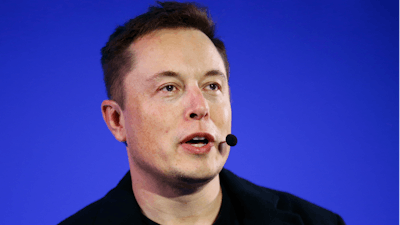

DOVER, Del. (AP) — Delaware's Supreme Court has upheld a judge's decision in favor of Tesla CEO Elon Musk in a lawsuit challenging the electric car maker's $2.4 billion acquisition of a solar panel company founded by two of his cousins.

The court on Tuesday rejected arguments from a group of Tesla shareholders that a Chancery Court judge erred in finding that Tesla's deal to acquire SolarCity in 2016 was "entirely fair." The judge made that determination even while finding that the process by which Tesla's board of directors negotiated and recommended the deal to shareholders was "far from perfect."

While noting errors in the trial court's fair price analysis, and agreeing that the deal process was not "pitch perfect," the justices said the record is replete with factual findings and credibility determinations indicating that the acquisition was "entirely fair."

"We are convinced, after a thorough review of the extensive trial record, that the trial court's decision is supported by the evidence and that the court committed no reversible error in applying the entire fairness test," Justice Karen Valihura wrote in the court's 106-page opinion.

Typically, under Delaware's "business judgment" rule, courts give deference to a corporate board's decision-making unless there is evidence that directors had conflicts or acted in bad faith. If a plaintiff can overcome the business judgment rule's presumption because the deal involved a controlling shareholder or because directors might have been conflicted, the board's action is subject to an "entire fairness" analysis. That shifts the burden to the corporation to show that the deal involved both fair dealing and fair price.

At the time of the acquisition, Musk owned about 22% of Tesla's common stock and was the largest stockholder of SolarCity, as well as chairman of its board of directors.

The justices concluded that the findings by former Vice Chancellor Joseph Slights III, which were not challenged by the shareholders, support the conclusion that the overall deal process was the product of fair dealing. The Supreme Court also said that, while Slights failed to explain why and how he relied on Solar City's stock price on the day the deal was announced, rather than the lower price on the day the deal closed, his fair price analysis did not amount to reversible error.

"The Court of Chancery, after examining all of the expert testimony and fair price evidence, found that the fair price case was not even close," Valihiura noted.

An attorney for the shareholders argued in March that the Chancery Court judge put too much emphasis on the price Tesla paid for SolarCity, and not enough on the deal process, which the plaintiffs contend was tainted by the failure to appoint an independent committee to negotiate the deal. He also argued that the judge's analysis of the deal price was flawed and that shareholders who voted to approve the deal were not properly informed, even though the vote was not required under Delaware law.

A lawyer for Musk noted that the SolarCity acquisition had been a strategic objective for Tesla for 10 years before the deal was completed, belying the argument that it was a last-minute "bailout" to save an insolvent SolarCity from bankruptcy.

The Chancery Court's decision last year followed a July 2021 court appearance in which a defiant Musk defended the deal and sparred with attorneys for the plaintiffs, calling one lawyer a "bad human being." Musk chose to fight the lawsuit in court even after other directors on Tesla's board reached a $60 million settlement, without admitting fault.