WASHINGTON (AP) — After Rich Cruse saw about $3,000 in income for his photography business quickly disappear to the coronavirus, he tried to apply for unemployment benefits in California. But like many states, his isn't yet accepting claims from the self-employed like him.

That's left Cruse, 58, earning just meager pay driving for Uber Eats near San Diego. And he worries about the health risks.

“I wear a mask and am practically eating hand sanitizer,” he said. “It's not what I am supposed to be doing.”

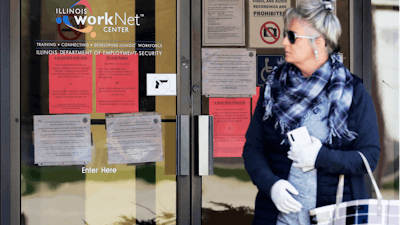

Even as nearly 17 million Americans have sought unemployment benefits in the past three weeks — a record high, by far — millions of people appear to be falling through the cracks. They can't get through jammed phone systems or finish their applications on overloaded websites. Or they're confused about whether or how to apply.

And now there is a whole new category of people — gig workers, independent contractors and self-employed people like Cruse. The federal government’s $2.2 trillion economic relief package for the first time extended unemployment aid to cover those workers when they lose their jobs. Yet most states have yet to update their systems to process these applications.

The struggles at U.S. unemployment systems run by the states contrasts with the smoother and more robust protections that many European governments provide for millions who have been thrown out of work as a result of the viral outbreak. In France, for example, 5.8 million people — about a quarter of the private-sector workforce — are now on a “partial unemployment” plan: With the government's help, they receive part of their wages while temporarily laid off or while working shorter hours.

Larisa Ignatovich, who works as a household helper for families around Paris, is among them. French confinement measures mean she can leave only to buy groceries or for medical emergencies. When the confinement rules were imposed in March, her husband’s construction work dried up, and she could no longer work. Ignatovich feared they would lack money for food and rent.

But then the government announced special programs to help prevent virus-related layoffs. Under the plan, Ignatovich’s employers continue to pay her, and the government reimburses the employer 80% of the sum.

Many European governments seek to subsidize wages in downturns so that workers can remain attached to their employers. By contrast, the U.S. approach typically is to provide support to those who've lost jobs. But unemployment aid doesn't cover everyone. It can be limited to six months or less.

Some economists argue that the European approach explains why unemployment rates there don't spike as high in downturns as in the United States, and fewer workers drop out of the workforce compared with the United States.

The new U.S. economic relief package does include $350 billion in loans for small companies that agree to retain or rehire their employees. These loans are forgiven if they're used for wages. But that program is off to a rocky start. And Treasury Secretary Steven Mnuchin has already asked Congress for more money given the tidal wave of applications for the loans.

For workers with traditional jobs, state unemployment agencies can use their employers' tax records to confirm that they're employed and determine their earnings history to set their benefit levels. Those workers are eligible in part because their companies pay into state unemployment funds.

By contrast, self-employed and gig workers typically haven't contributed to unemployment funds. And neither have the online platforms that they work through. Now that they're eligible for jobless benefits, those workers will have to provide paperwork to document their incomes. Compounding the challenges, the federal government is providing an additional $600 per week of jobless aid beyond what states provide. This federal money must be routed through the states — another new responsibility.

All of this takes time, which means money can’t get to the jobless recipients very quickly.

“I suspect it may take much longer than governments and workers want before the unemployment benefits arrive," said Dmitri Koustas, an assistant professor of public policy at the University of Chicago.

Under the economic relief package, the federal government will pay the benefits for the self-employed and other newly eligible groups. But states must evaluate whether an applicant is actually eligible. Koustas says many states fear they'll be stuck with the bill if they mistakenly approve someone.

For that reason, some states are requiring the self-employed and gig workers to apply for regular state unemployment benefits first. Only if their claims are rejected can they apply for the new federal coverage.

Massachusetts has warned that its unemployment office won't be able to accept claims from gig workers, contractors or the self-employed until April 30. The office has turned to a vendor to establish a new platform for those applications.

In North Carolina, the state unemployment office, which has received a whopping 497,000 jobless claims since mid-March, said it won't likely be able to accept applications from independent contractors and the self-employed for two more weeks.

Pringle Teetor, 62, of Chapel Hill, had to close the glass-blowing studio she co-owns after her revenue evaporated once local art galleries shuttered and spring festivals were canceled. She's filed for unemployment benefits. But Teetor isn't sure whether her application cleared because she kept getting dropped off the computer system. Though she has some savings, she may seek other work if she can't reopen her studio soon. Her husband’s dental practice remains closed.

“If this goes on much longer, it’s going to change everything,” Teetor said.

In California, Cruse tried to apply unemployment benefits after two of the road races that he photographs for charitable groups were canceled. But after filling out forms online, he was told he wasn't eligible. The state has yet to update its website for self-employed workers.

Cruse used to regularly take sunset photos from the beach, which he would post on social media to promote his photography business. But with the beaches closed, he can't even do that.

“The prospects aren’t that great for me for the next two to three months at least,” he said. “All the existing work that I have is gone.”