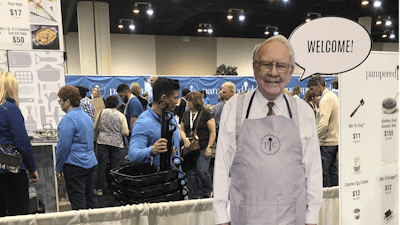

OMAHA, Neb. (AP) — Warren Buffett's Berkshire Hathaway continued buying Occidental Petroleum shares this week just days after he told shareholders that he had amassed a 14% stake in the oil producer.

Berkshire Hathaway now controls 15.2% of Occidental's stock after buying nearly 5.9 million more shares on Monday and Tuesday. The conglomerate disclosed the latest purchases in a filing with the Securities and Exchange Commission Wednesday.

Occidental's shares opened at $63.56 Thursday after the disclosure before falling off to $61.97 in the afternoon.

Buffett said at Berkshire's annual meeting on Saturday that he loaded up on Occidental shares earlier this year after reading a presentation the company put together that made a ton of sense to him. Berkshire's stake in on common stock of Houston-based Occidental is now worth roughly $8.8 billion, but Berkshire also holds $10 billion worth of preferred shares in the company and warrants to buy another 83.9 million Occidental shares for $59.62 apiece.

Berkshire's Occidental purchases were one of the highlights Buffett mentioned when telling shareholders about what the Omaha, Nebraska-based company spent $51 billion on. Berkshire also invested heavily in oil giant Chevron and picked up a few more Apple shares to expand its massive stake in the iPhone maker.

Buffett's spending spree helped reduce Berkshire's cash pile to $106 billion at the end of the first quarter from $147 billion at the beginning of the year. But he still has plenty to spend even though he says he'll always keep at least $30 billion on hand to cover any significant claims on insurance policies Berkshire's companies write.

Besides investments, Berkshire owns BNSF railroad, several major utilities, Geico and other insurers and an assortment of manufacturing and retail companies. Thousands of people packed in Omaha arena last weekend to hear Buffett spend hours answering questions about the company at its annual meeting.