DETROIT (AP) — Sky-high sales prices for its pickup trucks and SUVs helped Ford Motor Co. turn a surprise second-quarter profit despite a global shortage of computer chips that cut factory output in half.

The Dearborn, Michigan, company said Wednesday that it made $561 million from April through June, largely because of cost cuts and higher-than-expected prices for its vehicles.

The automaker warned earlier in the year that it would be hit especially hard by the chip shortage and a fire at Japanese supplier Renesas that manufactures many of its automotive-grade chips, resulting in a second-quarter loss.

But Ford surprised investors by earning 13 cents per share excluding one-time items. That was far better than Wall Street expectations of a 3-cent-per-share loss, according to FactSet.

Revenue was $26.8 billion, also above analysts' forecasts of just over $23 billion.

Ford raised its guidance for full-year pretax income by about $3.5 billion to between $9 billion and $10 billion. But it cautioned that higher commodity prices and capital investments would offset second-half wholesale volume that it expects to rise by about 30% over the first half.

Orders are up for the electric Mustang Mach-E SUV and the new Bronco SUV, making Ford’s business “spring loaded” for a rebound when chip supplies stabilize, CEO Jim Farley said in a statement.

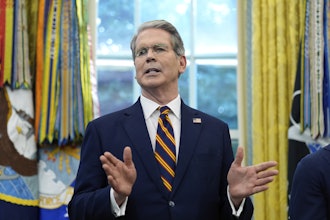

Chief Financial Officer John Lawler said Ford expects production to improve in the second half of the year. He said it has a bank of orders seven times larger than it was a year ago due to new vehicles. For instance, the company has about 120,000 reservations for the new F-150 Lightning electric pickup truck, and about three quarters of them are new customers for Ford, he said.

During the latest quarter, sales in the U.S., Ford's most profitable market, rose nearly 10% over last year's pandemic-ravaged quarter. But the company lost more than a quarter of its U.S. market share, which fell to 10.6%, according to Edmunds.com.

Still, Ford's average U.S, vehicle sales price, led by the F-Series pickup, rose 6.3% to $47,961 for the quarter, bringing the company badly needed revenue.

Lawler blamed the market-share decline on short supplies due to factories being shut down because of the lack of chips. He said the company has a good chance to regain that share as the shortage wane, and it will work hard to fill orders.

Ford had predicted in April that the chip shortage would cut its second-quarter production 50%, or by 1.1 million vehicles worldwide. Lawler said it did indeed lose about half of its production worldwide, with factory output about 700,000 vehicles below Ford's initial plan.

But the company allocated available chips to its most profitable vehicles, he said.

Lawler said the Renesas plant's production line damaged by the fire should produce more in the second half of the year, alleviating some of the chip shortage. He said he sees the shortage running through this year into the first part of 2022.

“We need to see relief coming through before we can really feel comfortable that we're out of the woods here,” he told analysts on a conference call.

But Lawler cautioned that increased prices for raw materials will take about $2 billion out of its pretax income in the second half. Also, pretax profits at Ford's credit arm — $1.6 billion last quarter — will likely fall by $1 billion from the first half as values of vehicles returning from leases drop closer to normal.

“We do have some headwinds but we like the underlying strength of the business,” he said.

High prices are likely to continue as long as there is an imbalance between low supplies and strong demand, Lawler said, although he said he expects prices to fall a bit in the fourth quarter.

“We expect to have relatively strong pricing power for the foreseeable future,” he said.

Lawler said the company has produced and stored 60,000 to 70,000 vehicles without chips, and it will retrofit them when the parts are available. Ford will increase inspections to make sure the vehicles have the same quality as those that went directly through assembly lines, he said.

Ford's stock was up almost 4% in extended trading following the release of the earnings report after the close of Wall Street's regular session Wednesday.