As the calendar flipped over to 2025, two of North America’s most prominent distributors closed the books on what ended up being the blockbuster M&A announcement of the previous year.

Applied Industrial Technologies issued a statement on the first business day of the new year that it had completed its acquisition of Hydradyne LLC on New Year’s Eve, wrapping up its latest quarter with the combination of two major players in the fluid power distribution market.

Applied, of course, had already long established itself as a leader in fluid power and flow control, as well as in industrial motion, automation and maintenance products. A $3 billion company in the late 2010s, Applied closed its most recent fiscal year with $4.4 billion in sales — landing at no. 8 on ID’s 2024 Big 50 list of North American industrial distributors.

Company executives credited its performance to its strategy and differentiated market position, among other factors, but like many major distributors, Applied – which dates back to a Cleveland bearings distributor founded in 1923 – also maintained an aggressive position on acquisitions. Applied had added eight companies in total since 2010, including Olympus Controls, Advanced Control Solutions and Bearing Distributors.

In October, while reporting the results of the first quarter of its new fiscal year, Applied executives said that it expected to see increased capital spending throughout the year despite a “choppy” sales environment — including “strategic bolt-on and mid-size acquisitions.” In the company’s earnings call, President and CEO Neil Schrimsher vowed to be aggressive on the M&A front, telling analysts, “We will not just stack cash.”

Turns out that still may have somewhat undersold what the company had in mind.

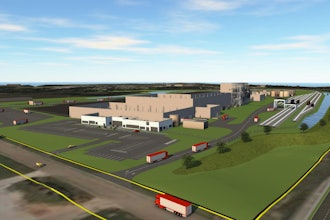

Less than a month later, Applied announced the agreement to buy Hydradyne. The newly added distributor brought more than 30 locations across the Southeast and a staff of nearly 500 – serving more than 8,000 customers worldwide – to Applied’s operations.

Hydradyne LLC

Hydradyne LLC

Applied officials expect the deal to bolster its revenue numbers by some $260 million and add $30 million in earnings before interest, taxes, depreciation and amortization prior to “anticipated synergies.” It is also projected to bolster earnings within the first year before factoring in related expenses or accounting adjustments.

More important, however, according to Applied officials, was its potential impact on the combined company’s position in the industry. Hydradyne, Applied executives said, would bolster the company’s “Engineered Solutions” segment by adding technical capabilities and engineering expertise across both legacy and emerging markets — particularly in a growing, strategically important region.

What’s more, Schrimsher said that the deal provided a way to add a company – from its staff to its approach to the market – that “we have always admired.”

Hydradyne, meanwhile, said that Applied offered “the best strategic fit” for the company’s employees, as well as its suppliers and customers. Hydradyne President Lon Jennings said the announcement marked “an opportune moment” for the company.

“Joining Applied will accelerate our potential by leveraging complementary capabilities, innovative fluid power solutions, and a leading technical industry position as a mutual team,” Jennings said.

As for what Applied had to pay in order to secure Hydradyne’s operations? That continues to remain a mystery, but answers will likely be forthcoming at the end of January. Applied officials said that further financial and operational details of the transaction – including guidance regarding its impact on earnings – would be disclosed during its next quarterly earnings report.

By that point, the company will already be well into the back half of its current fiscal year — during which, officials said, they expect to see momentum build in the Engineered Solutions segment.