IEN talks with Microsoft’s Bill Moffett on expanding customized approaches, and how tech has finally caught up with longstanding ideals.

Jeff Reinke, editorial director, IEN: What are your thoughts on the state of the industrial marketplace, and manufacturer’s attitudes towards software and technology-focused investments?

Bill Moffett, Global Industry Marketing Manager – Manufacturing: Traditionally, the industrial marketplace has been very segmented and highly customized, so there’s a huge amount of opportunity.

More specifically, the concept and full application of ERP continues to expand. From accounting to inventory management to CRM, an overall need to understand all the processes and how they interact continues to grow. They know they need to understand data, which is why we’re seeing heavier levels of investment in the analytics. It’s not just about data dropping from the cloud, but what do you do with it.

Then, understanding how to use this information to identify and define trends becomes vital. So If trend A occurs, business decisions can be guided from of an understanding of how to access and analyze the appropriate data. It’s all about how this will enable manufacturers to make a decision more quickly, and hopefully in real time.

And it’s not just about production or supply chain data, but implementing quick feedback from customers that can impact production decisions. In response, we’ve seen a growing need for tools that can not only monitor data from sensors throughout the shop floor, but social media and other streams of consumer feedback.

It’s all about customer perceptions vs. reality. Now both can be analyzed and changes inputted accordingly.

JR: You mentioned the use and application of all the data that is now available to manufacturers. Do you think this is the biggest challenge they currently face on the IT side of things?

BM: It’s a digital world, and manufacturers are working to understand how they can leverage tools that will make them better. It’s a focus that needs to go beyond operations and operational efficiency.

Manufacturers need to identify and leverage technologies that enable them to grow their market while still focusing on ways to work more closely with customers – again leveraging social media and analytics to service their customer, grow in new markets and innovate. This might include building services into the product or selling new capabilities based on a relationship.

This opens doors that are mutually beneficial to both and instilling a direct connection to consumers so the enterprise is not as dependent on third parties.

JR: So what types of approaches have you seen implemented to help improve these connections?

BM: ETO (engineered to order) production approaches can help manufacturer’s customers get what they want when they want it. Henry Ford’s original approach of offering consumers any color of automobile they’d like … as long as it’s black, simply doesn’t work anymore. Manufacturers need to explore being as customized as possible.

Microsoft’s latest technologies are focused on that, like our cloud-based Azure platform. It’s scalable to multiple production facilities and uses applications that are conducive to implementing customer feedback.

Quality manufacturing tools are not just about operational efficiency – it’s about getting connected to the customer and staying closer to them. This can also mean having a common set of tools across multiple locations to help preserve quality. That’s why our offerings for the industrial sector have taken on the same look and feel as Microsoft Office.

JR: What are some of Microsoft’s biggest challenges in growing their presence within the industrial sector?

BM: Time is always a big thing, especially for many mid-sized companies that may have been bitten in the past. By that I mean they’ve gone through a long-term implementation and want to make sure they get as much return as possible, and they’re hesitant to go through that process again.

That’s why we stress how our Cortana Intelligence offering allows you to take bits and pieces and pick and choose want you want if you’re a non-enterprise level customer. They can compartmentalize functionality to get the most out of individual products.

JR: Other than software, what types of technologies do you see having the biggest impact on the industrial sector?

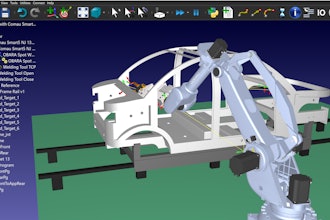

BM: Sensor technology has become not only highly effective in collecting data, but also cost effective. This stimulates more back and forth communication. 3D printing is another key technology.

So is total connectivity through smart devices. Instead of watching machine controls on site, an app on a cell phone allows you to control the settings. Smart devices will continue to open new doors.

However, these devices need to complement the culture of the company. If you’re going to be open, then you need to have strong security processes in place. BYOD (bring your own device) will continue to grow so manufacturers need to get unified in their SOPs.

I still believe that our world is global but not as big as it used to be. The tech in place is opening doors to really succeed where we had limitations in the past. For example, I loved Matchbox cars growing up because those were designs that you never thought you’d see on the road. Now the kids playing with those cars are designing those cars because the tech is in place to match what customers are seeking.

The manufacturing revolution is occurring and the U.S. will be in the middle of it because of this vision. We’re no longer limited by technology so now we need to design business processes that work better with the tech.